Enterprise AI adoption in 2026: Trends, gaps, and strategic insights

Based on Lucidworks’ 2025 AI Benchmark Study of 1,600+ AI leaders and autonomous analysis of 1,100+ companies

Heading into 2026, enterprise AI has entered what you might call a stage of cautious maturity. The enthusiasm is still there, but organizations are realizing that scaling AI is far more complicated than launching a pilot. Our latest research — drawing from a global survey of over 1,600 AI leaders and independent analysis of 1,100 company deployments — shows both the progress and the widening execution gap.

The state of AI: hype meets reality

On paper, adoption looks strong. More than seven in ten organizations have introduced generative AI into their operations. Yet when you look closer, only 6% have fully implemented agentic AI—the next frontier in intelligent automation.

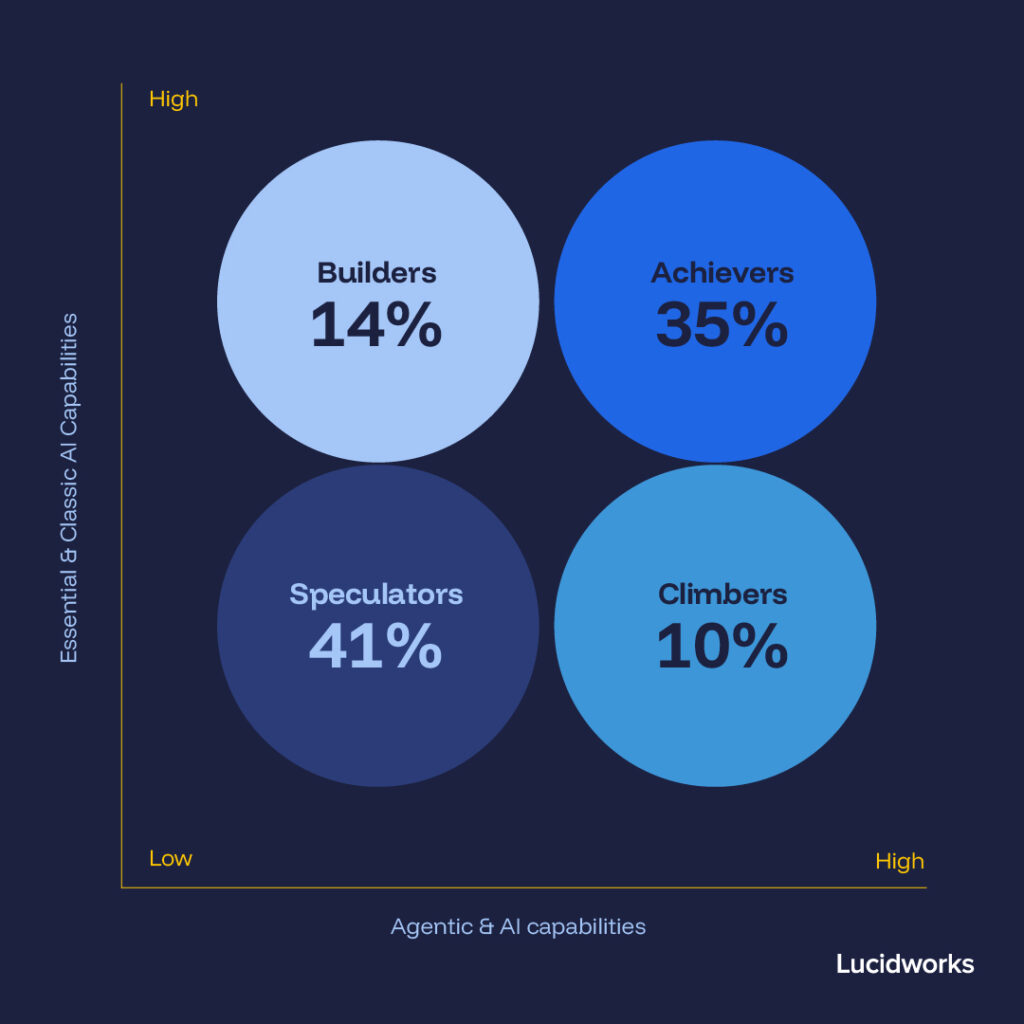

Companies tend to fall into four categories. Some are Achievers (about a third of the market), balancing foundational and advanced capabilities with relative ease. Others are Builders, solid on the basics but still expanding. Climbers have experimented with advanced use cases but lack core operational underpinnings. And then there are the Spectators, a sizable 41%, with little to show for their AI ambitions.

Industry differences are just as telling. B2C companies are leading with 41% in the Achiever camp, while B2B trails at 31%. Healthcare organizations report the strongest benefits realized from AI investments, while the tech sector unsurprisingly leads in advanced adoption.

The AI anxiety spike

Adoption hasn’t quieted concerns—if anything, it has amplified them. In 2025, a staggering 83% of AI leaders say they feel major or extreme concern about generative AI. That’s an eightfold increase in just two years.

The worries cover familiar ground but with far greater intensity: implementation costs that balloon faster than expected, growing questions around data security, frustration over unreliable outputs, and a lack of transparency in decision-making. Even job displacement, once a background fear, is now front of mind for more than a quarter of respondents.

AI is no longer a shiny experiment—it’s a risk management challenge.

Budgets: from hype to strategy

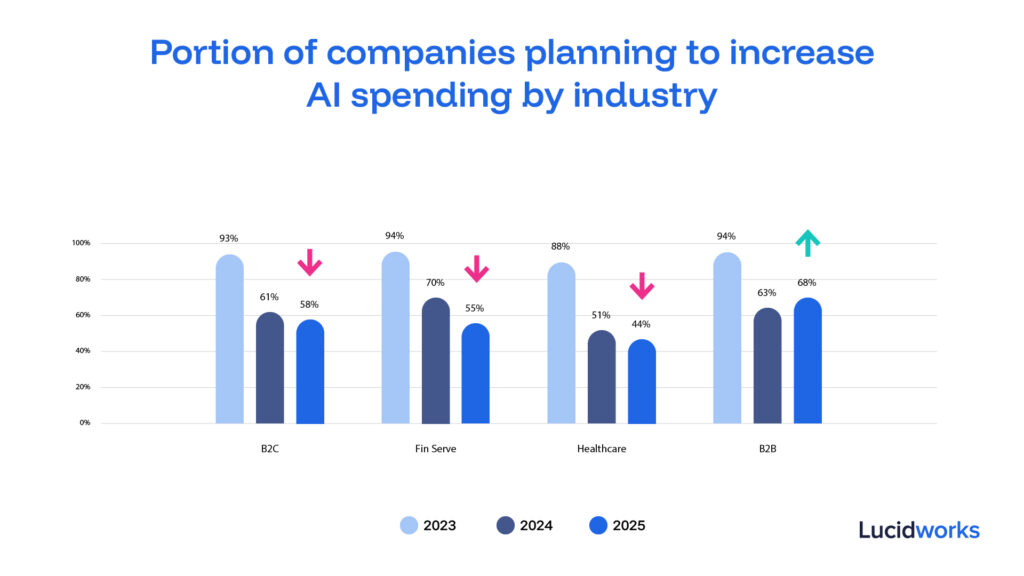

The spending picture reflects this shift in mindset. Back in 2023, nearly every company said they planned to increase AI budgets. By 2024, that number had nearly halved. This year, spending has stabilized at around 62% planning increases.

Healthcare and B2B organizations are now the most aggressive investors, with nearly seven in ten increasing budgets. Financial services is following closely. Across the board, the era of blank-check pilots is over; companies are channeling investment into targeted projects with clear ROI.

What’s really being deployed

Despite the hype, most of the real progress has been made in foundational capabilities. In e-commerce especially, companies have focused on relevancy ranking, dynamic faceting, and showing product availability—features that directly support conversion. But gaps remain: fewer than four in ten companies support multiple languages, a glaring weakness in global markets.

Advanced capabilities, by contrast, are still finding their footing. Hybrid and vector search have gained meaningful traction, but tools like conversational commerce and AI chatbots remain rare, especially in B2B.

Why the basics still matter most

The data makes one point very clear: without strong foundations, advanced AI simply doesn’t deliver. Companies that put the essentials in place first—things like search relevancy and multilingual support—see far greater conversion lifts than those skipping ahead to trendier technologies. Even the most advanced adopters report diminishing returns when core systems are weak.

The lesson is simple: get the basics right, and everything else compounds.

Sector snapshots

Progress varies dramatically by industry. Retailers and mass merchants have nearly universal adoption of foundational capabilities, but only a fraction have ventured into agentic AI. Automotive companies show a similar pattern, with solid coverage of the basics but little agentic experimentation. Tech firms are further ahead, with almost all foundational boxes checked and nearly a third already deploying agentic solutions.

Models in play

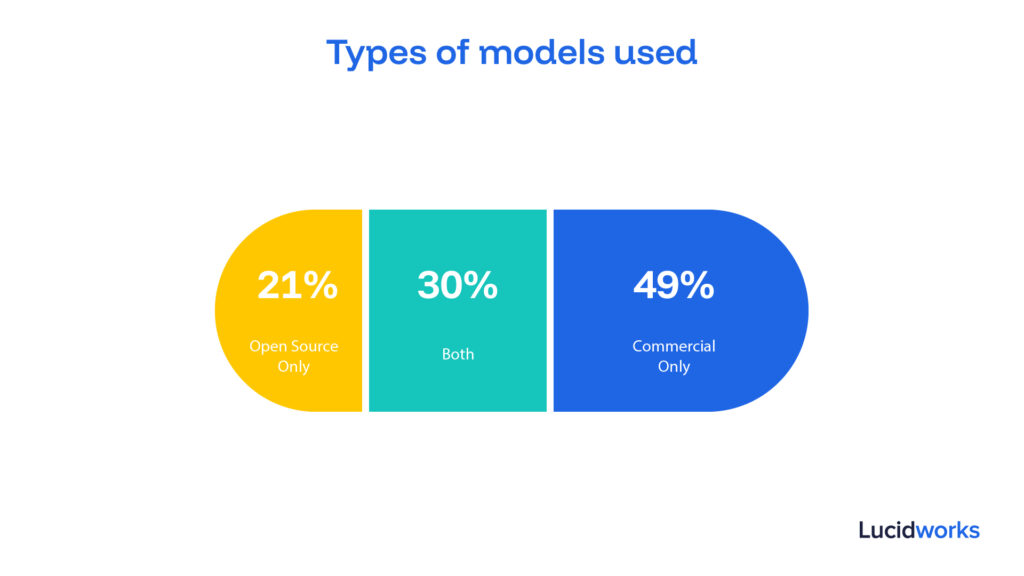

When it comes to model strategy, the market is split. About half of companies rely solely on commercial models like GPT-4 or Claude. A growing 30% mix commercial and open source, while one in five have gone fully open source. Interestingly, most organizations stick to a single model, signaling that despite all the talk of model diversity, simplicity still rules.

The reality of agentic AI

Few areas demonstrate the hype-versus-reality divide more starkly than agentic AI. Despite its buzz, only 2% of companies have deployed more than one agent. Most of those exploring agentic approaches haven’t launched a single production system.

Where it is emerging, agentic AI tends to fall into four buckets: analytical agents for market research, logical agents for tasks like inventory management, transactional agents in customer service, and physical agents in logistics and manufacturing. But for now, these remain exceptions rather than the norm.

5 strategic insights for leaders

From all of this research, five themes emerge for executives shaping their AI strategy:

- Start with the essentials. Foundational capabilities drive real ROI; advanced tools can’t compensate for weak basics.

- Balance innovation with stability. The most successful companies invest in the fundamentals while carefully piloting next-gen AI in parallel.

- Plan for rising concerns. Leaders must get ahead of transparency, security, and cost issues before they escalate.

- Know your sector. B2C is out in front on adoption, B2B is leading investment, and healthcare is realizing the strongest returns.

- Mind the execution gap. Ambition is high, but execution is what separates the winners from the laggards.

About the research

This analysis blends two lenses: Lucidworks’ agentic intelligence system, which assessed AI capabilities across more than 1,100 companies, and survey insights from 1,600 AI leaders across industries and regions. Together, they provide one of the most comprehensive snapshots of enterprise AI adoption to date.

Source: Lucidworks 2025 AI Benchmark Study – “Dawn of the Agentic AI Era”