3 Ways to Supercharge Your Advisors Investment Research

We cover a few easy ways to support investment advisors in financial services navigating their own data through search.

A competitive edge. It’s what every investment institution and wealth management division seeks to provide its advisors as they determine where to place a client’s next investment.

With many leading financial institutions well into the upper right quadrant of their digital maturity, this edge is often less dependent on having access to more data. It comes down to an advisor’s ability to effectively utilize all the information that’s made available to them so they can make sound investment decisions.

In this post we’ll explore three ways to give your advisors that edge. Interested to see it applied in action? An investment institution with $1.3 Trillion AUM recently empowered a team of 15,000 advisors. Check out the case study here.

Make It Easy & Accessible

So your organization has done the hard part. You have a talented analyst team that’s producing reports about relevant industries, markets, sectors and companies. You subscribe to & pay for external research reports and data feeds. Data science teams are developing home-grown models to predict performances and track trends. And a robust digital landscape has been implemented to monitor client risk profiles, past transactions and relative returns.

Here’s the challenge…

While all of this should provide an advisor with what they need to be effective, if they are required to jump across a number of internal applications to both access and then find all the relevant information that may be available to them, a few things may occur:

- Less Effective Advisors: An advisor may simply omit or forget about checking that ‘one additional repository’ before making a decision. The frequency of this may increase if advisors are responsible for managing a large client portfolio and are often crunched for time. If additional information found in that repository may have changed an advisor’s decision, it could drastically impact returns & client satisfaction.

- Decreased Productivity: Toggling across applications and searching through numerous repositories throughout the day reduces advisor productivity and limits the amount of time and Advisor can spend with each client. An organization with a large advisor division can quickly see millions lost in productivity alone.

To overcome these challenges, organizations should provide advisors with a single application that allows them to search through and access all available repositories within the organization.

Valuable Nuggets Are Often Buried Deep

If you’ve implemented a single search experience across your organization’s repositories you’re one step closer…but not so fast.

How you index content within the search engine of your application matters. Especially when advisors need to access both semi-structured data (investment, financial, and research reports, policy documents, etc.) and structured data sets (portfolio profile, transactions, customer master, etc.) to make decisions across public & private markets. What you index for each piece of content is the mechanism a search engine uses to determine whether or not a piece of information is relevant to an advisor’s search. Your indexing strategy thus directly impacts the speed & thoroughness of advisor research.

Take many traditional search engines, for example. They may only index high level document attributes including the:

| Title: | 2023 Real Estate Marketing in Malaysia |

| Author: | John Smith |

| Published Date | February 15, 2023 |

| Tags | real estate, property, Malaysia, housing crisis |

While this may be a good start, there’s a treasure chest of information buried within the text, tables, images and body of a document that make a piece of content relevant.

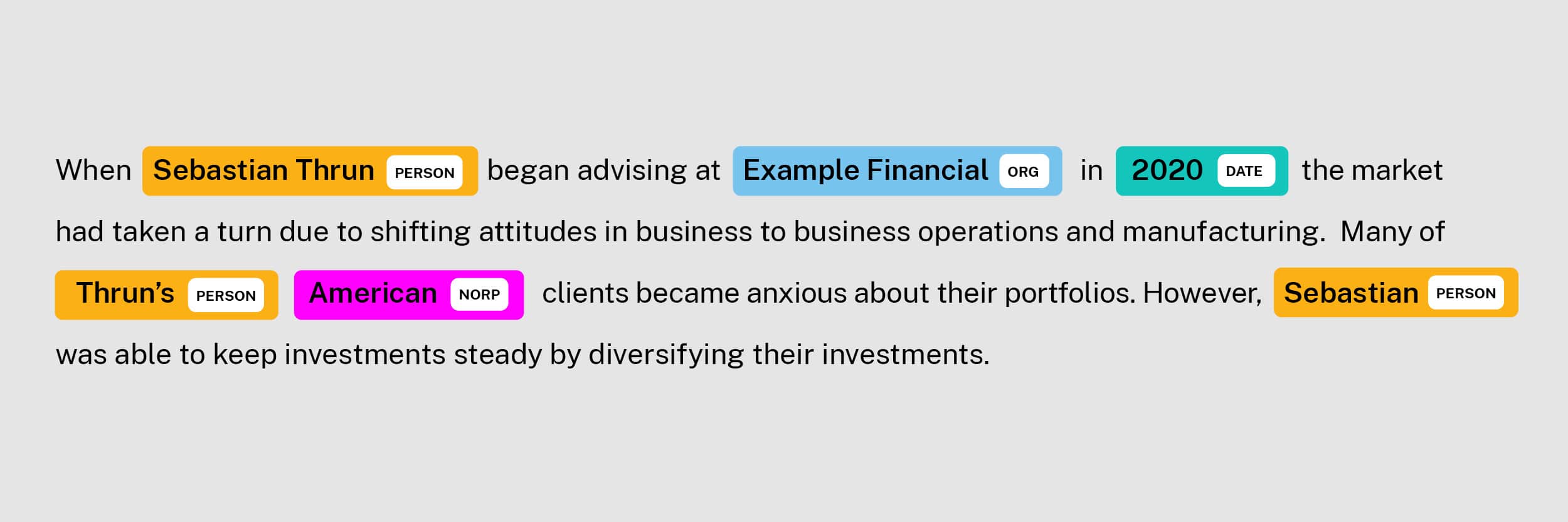

Using concepts like Named Entity Recognition (NER), topic detection and document clustering your search application can index and structure all the relevant information available within a piece of content. These techniques can also automate the process of meta-tag enrichment to reduce the manual overhead typically required to appropriately tag a document. This can dramatically decrease advisor research times as it can improve result relevance and provides advisors with a more thorough understanding of all the assets available.

Personalize the Experience

A research experience doesn’t need to be static and start at the same blank slate for each advisor. Personalization can fast track the decision making process for advisors that oversee different sectors and regions and manage very different books of business.

One way to personalize the experience is to utilize known data points about each advisor to tailor results and rerank the order in which content is returned. This includes information about an advisor’s division, geographic location, document access level, seniority level and client portfolio. For example, an advisor that oversees a book of business with investments in Southeast Asia and searches for ‘2023 real estate outlook’ should likely receive a different set of results on the first page than an advisor that manages a book of business in North America and enters the same search.

This level of personalization can also be applied to power smarter recommendations within the research application. This may take the form of sections that showcase ‘frequent searches from others on your team’ or ‘advisors that engaged with this piece of content also viewed’.

Personalization can be taken one step further by utilizing an advisor’s actions from past research sessions to rerank the results that are shown. This means tapping into information from Adobe Analytics, Google Analytics or your Content Management System’s native analytics module to understand more about each individual advisor. This information may include what type of content is frequently clicked on, which data sources are frequently engaged with, what past searches have occurred and more. At scale, this behavior-based personalization turns a research application into a self-tuning engine that becomes smarter and more personalized to each advisor over time.

Eager to take the next step? Lucidworks partners with some of the top financial organizations to supercharge advisors’ investment research. We’d love to show you how we can make it easier for advisors to find what they need, save valuable time, and create a best-in-class client experience. Contact us today to learn more.

LEARN MORE

Contact us today to learn how Lucidworks can help your team create powerful search and discovery applications for your customers and employees.