The Importance of Personalization and Customer Experience

In today’s digital, multi-channel world, simply remembering a customer’s name when they log in isn’t enough. Banks and financial providers must work harder to personalize their offerings and attract new customers.

In the analog age, the best bankers would build brand loyalty simply by knowing the names of their customers and striking up a rapport with them. However, in today’s digital, multi-channel world, simply remembering a customer’s name when they log in isn’t enough. Banks and financial providers must aim to personalize their offerings and deliver the “you know me” service that consumers desire.

Data Remains King for Banking

Businesses must prioritize interpreting customers’ digital actions to understand their preferences and better cater to their needs. These signals show leaders what people click on, what types of accounts they research, the offers they ignore, and when they reach out to customer support. Through collecting and analyzing these signals, financial services organizations can predict customer intent and make proactive suggestions, sometimes before they’ve ever asked the business for assistance.

Major technology companies such as Amazon, Facebook and Google have mastered personalization and set consumer expectations for a similar experience in every digital interaction. Many organizations possess the “raw ingredients” to power a more personalized experience, and the touchpoints to deliver that personalization. However, many are still failing to create the right recipe for turning this valuable data into insights and action.

Customer Segmentation and Banking Analytics

In order to gain a competitive advantage, financial organizations must invest in two areas of technology: behavioral customer segmentation and agile analytic capabilities. The old habit of using aggregated data and demographic characteristics to predict consumer behavior will prove even less predictive and useful than before. Consumers expect financial organizations to now know them in the same way lifestyle, hospitality and retailers do. Even without Amazon-like capabilities, understanding customer behavior data and being able to respond in real time can dramatically improve the customer experience.

Agile analytic capabilities is the other side of this equation. Many households mitigate risk, and maximize their options by maintaining account relationships with multiple firms. Global banks that have the ability to notice subtle changes at the consumer level will be better positioned to preserve relationships at risk.

COVID-19 Banking Trends

COVID-19 has driven many more customers to use online banking channels for the first time. Many now prefer online to traditional methods, for the sake of convenience and personal safety. This means that retail banks and capital markets advisory firms will not have as many opportunities to consult with depositors and investors in-person. Those consultations are an important part of the sales cycle for their high-margin products, and so organizations will invest in digital customer touchpoint technologies in order to preserve those sales opportunities.

There were three emerging trends already underway before the COVID-19 pandemic: the shift towards cloud computing, the rise of question-answering systems, and the adoption of digital voice assistants. COVID-19 dramatically accelerated those trends.

Cloud computing reduces the cost of maintaining personalized digital experiences. As public cloud infrastructures reach parity with on-premise data centers, in terms of perceived security vulnerabilities, more banks will shift towards cloud computing to reduce the cost of maintaining a diverse array of digital touchpoints.

In a recent webcast with Google Cloud, Lucidworks CEO Will Hayes shared, “Across the Global 2000, every enterprise conversation of late has been focused on cloud. It’s exciting to see the acceleration of this transition to the cloud happening before our eyes. A portion of the business we assumed would be on premise is now moving to the cloud.”

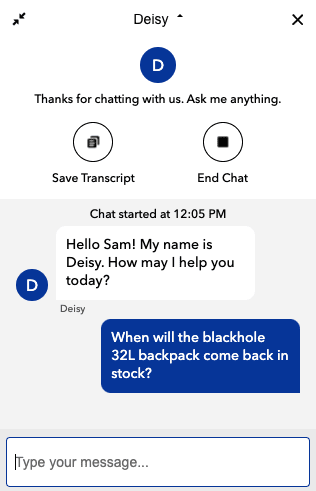

Beyond that, the growth of question-answering systems, powered by deep learning, will become better at mimicking natural language interactions between a customer and a member of staff. Consumers are becoming familiar with chatbots and virtual assistants. With question-answering systems, those conversational frameworks can learn for themselves and understand more subtle human nuance.

Most Q/A systems are nothing more than keyword matches with a robust FAQ. Advancements with NLP (natural language processing) make it possible to understand a wide array of sentence structures (even with misspellings) and retrieve the right answer so customers can ask questions online the same way they would speak with a customer service representative in person.

Finally, voice assistants will become capable of handling customer conversations at the early stages of financial planning. Over time, this self-service option will free financial advisors to focus on the higher-value conversations towards the end of the decision process.

The desire for digital and voice assistants is clear. For example, Bank of America, an early adopter in the industry, launched its voice activated assistant, Erica, in 2016. In March of 2019, it announced a suite of enhancements to the product, and reported that in under three years it had amassed more than six million users, answered more than 35 million client requests, and learned upwards of 400,000 different ways in which questions can be asked.

The Digital Banking Future

As the pandemic restrictions are gradually relaxed across the world, it is clear that global banking and financial organizations need to work even harder to differentiate themselves, in order to retain existing, and attract new customers. Brand and personalization are the key-drivers to this multi-channel and digital future. The most progressive global banking and financial organizations are already embracing an effective data analytic strategy, to support decision-making and to set themselves apart from the competition. Are you there yet, or is there more work to be done?

The original version of this article can be found at Global Banking and Finance Review.

LEARN MORE

Contact us today to learn how Lucidworks can help your team create powerful search and discovery applications for your customers and employees.